Executive Summary

Shamrock Chimney is a multi-state chimney and masonry company operating across more than 20 states. For years, the business had successfully scaled on the back of Angi leads—to the point where they were granted a flat-rate, unlimited-volume contract. With a full inside sales team and a proven appointment-booking process, Shamrock built an operation designed to handle serious lead volume.

Over time, however, that volume began to decline. While lead costs remained attractive, the reduced flow created a new problem: underutilized chimney technicians in key markets. Rather than panic or overcommit to a single alternative, Shamrock took a disciplined approach. They decided to test multiple marketing channels and vendors simultaneously—measuring performance side by side—to determine whether owned marketing channels could match their required volume while improving lead quality.

Improve & Grow was brought in as one of three partners in this controlled rollout. Our role was to test Google Ads and Facebook Ads across a defined group of states, with end-to-end lead tracking and CRM integration and closed-loop reporting to evaluate not just leads—but booked appointments and completed jobs.

In just 90 days, our campaigns generated over 2,000 leads, nearly 600 completed jobs, and an estimated $990,000 in revenue. More importantly, the data revealed a clear story: while Angi still delivered low-cost volume, Improve & Grow’s Google Ads campaigns produced higher booking and job completion rates—proving that exclusive lead channels could rival pay-per-lead sources at scale.

The Challenge

Shamrock Chimney’s challenge wasn’t a lack of demand—it was maintaining reliable lead volume at scale without overexposing the business to a single source.

For years, Angi had supplied the majority of Shamrock’s leads across more than 20 states. Their volume was strong enough that they had secured a flat-rate contract with unlimited leads, and the company had built a full inside sales team and a highly effective appointment-booking process around that model. But over time, Angi’s lead volume began to decline. While costs remained low, the reduced flow created a new operational risk: chimney technicians in key markets were no longer fully booked.

Before turning to paid advertising, Shamrock had already begun testing the development of organic lead volume with an existing marketing vendor. That effort focused primarily on SEO for a newly launched website, along with attempts to gain visibility through Google Business Profiles. However, progress was slow—partly due to the long-term nature of SEO, and partly due to ongoing challenges maintaining local listings without physical locations in each of the states they served. While organic visibility was improving incrementally, it wasn’t moving fast enough to solve the immediate capacity problem.

Recognizing that organic growth alone wouldn’t close the gap, Shamrock made a deliberate decision to test digital advertising. Rather than committing to a single agency or channel, they designed a controlled experiment: hiring three different vendors, assigning each a set of states, and running campaigns concurrently. The goal was not just to generate leads, but to determine whether owned digital channels could deliver the volume and quality needed to support their operation—without replacing one dependency with another.

That initiative set the stage for Improve & Grow’s involvement.

The Solution

Improve & Grow was brought in as one of three marketing partners as part of Shamrock’s multi-vendor testing initiative. Our mandate was clear: validate whether paid digital advertising could deliver high-quality leads at scale—while providing full visibility into performance from first click to completed job.

We began with a focused digital marketing strategy to test Google Ads in three states where demand was high but lead volume had begun to lag: Maine, New Hampshire, and Vermont. Using a combination of traditional search campaigns and Performance Max, we targeted high-intent queries tied directly to chimney services.

To support the ads, we built conversion-focused, state-specific landing pages on a dedicated subdomain. Each page featured a limited-time offer and clear service differentiation between chimney and masonry work. We tested multiple calls to action to determine what messaging and entry points would drive the strongest engagement.

Just as important as lead generation was attribution. We implemented call tracking numbers and lead forms that were fully integrated with both LeadHub and Shamrock’s CRM, WorkIZ. This ensured complete visibility into what happened after a lead came in—whether it was contacted, booked, and ultimately closed. The goal wasn’t just to generate leads, but to ensure Shamrock could trust the data behind every decision.

In less than a week, the campaigns and tracking systems were live. Shamrock saw lead activity within 24 hours. While initial lead volume was lower than what another vendor was seeing with Facebook Lead Ads, the quality of the Google Ads leads stood out immediately. Booking rates were higher, and early job outcomes were stronger.

Based on those early signals, Shamrock increased the ad budget and, within weeks, asked us to expand into additional states. They also requested that we begin testing Facebook Ads alongside Google in the same markets to compare volume, cost, and quality across channels.

As the broader initiative progressed and the first vendor was removed due to underperformance, Shamrock reassigned additional states to Improve & Grow. By that point, we were running both Google Ads and Facebook Ads across an expanded footprint—eventually supporting paid campaigns in ten states.

The Results

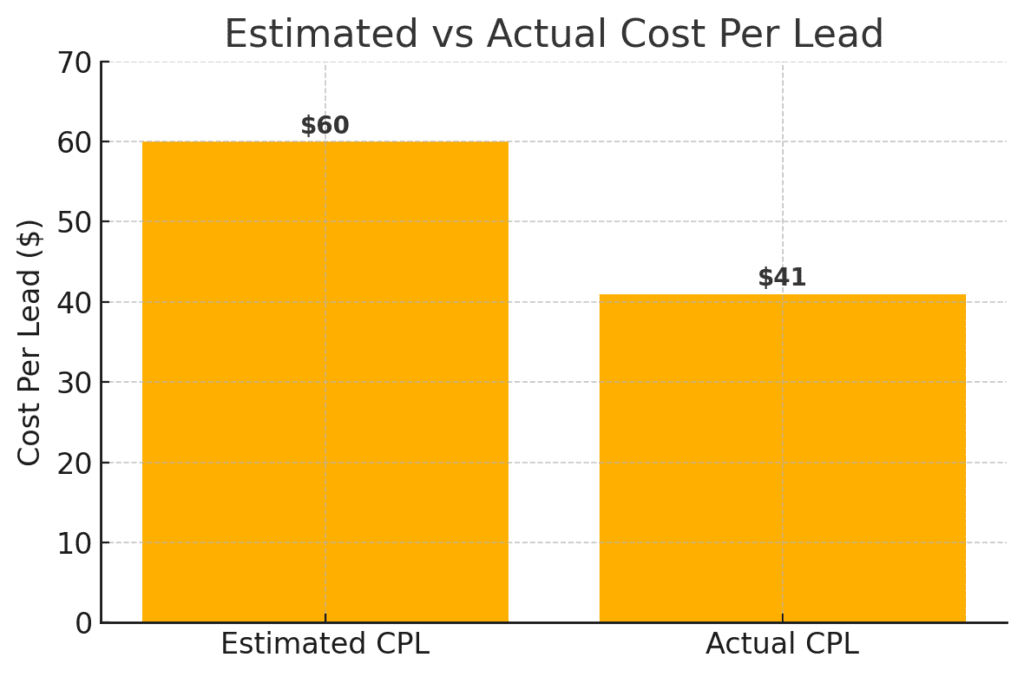

Over a three-month period, our campaigns generated 2,016 leads at an average cost per lead of $41, which was significantly below the initial target of $60 per lead. More importantly, the leads resulted in 1,111 estimates and 596 completed jobs. Based on Shamrock’s average job value, this effort drove over $990,000 in revenue with an 11X return on investment.

The outcome wasn’t just rapid growth—it was understanding. Shamrock was able to match meaningful lead volume, drive nearly $1 million in revenue, and see how each channel performed beyond the initial inquiry. With clear data on booking and job completion rates, the company finally had a true apples-to-apples comparison between pay-per-lead sources and owned digital campaigns.

What Changed

For Shamrock, this engagement wasn’t simply about adding another lead source—it was about gaining clarity and control. With reliable attribution in place and campaigns tied directly to booked appointments and completed jobs, they could finally evaluate performance beyond surface-level metrics like cost per lead.

The data confirmed what anecdotal feedback had suggested: while lead volume and costs varied by channel, owned digital campaigns—particularly Google Ads—were capable of approaching legacy lead-source efficiency while delivering stronger booking and job completion rates. For the first time, Shamrock had a clear, apples-to-apples comparison across vendors, channels, and states.

That visibility changed the conversation internally. It gave the team confidence not only to scale campaigns during the initiative, but to step back at the end of the busy season and evaluate their options from a position of strength. With nearly $1 million in attributable revenue and a proven framework in place, Shamrock validated that they could turn on high-quality lead generation outside of pay-per-lead platforms when needed.

Just as telling was how quickly trust was established. Within weeks, Improve & Grow went from testing campaigns in three states to supporting paid efforts across ten—expanding scope based purely on measurable performance and transparency.

Final Word

Shamrock Chimney’s story isn’t about abandoning one lead source for another. It’s about what happens when a mature service business stops guessing and starts measuring.

By deliberately testing alternative channels, demanding full-funnel visibility, and evaluating performance based on real operational outcomes—not just lead volume—Shamrock proved they had options. They validated that owned digital campaigns could deliver meaningful scale, approach legacy lead costs, and generate stronger booking and job completion rates than pay-per-lead platforms alone.

Improve & Grow’s role wasn’t to replace Angi or push a preferred strategy. It was to build a system Shamrock could trust—one that connected marketing activity to real business results and gave leadership the clarity needed to make confident decisions. Whether scaling campaigns, pausing investment, or renegotiating existing relationships, those decisions were made from a position of strength backed by data.

That’s what a true marketing partnership looks like—not hype or promises, but disciplined testing, transparent reporting, and outcomes a leadership team can stand behind.

If your business is ready to move beyond surface-level metrics and build marketing channels you actually control, Improve & Grow is built for that work.